While Tesla stock, the holy grail of the first year of the pandemic, has certainly cooled off in recent months, the EV company’s financial gains are anything but a bubble. As we saw this week when Elon Musk’s electric car sensation reported its second-quarter earnings, they can finally hold their own as a real-deal automaker; the net income of $1.1 billion, a record, was due in large part to selling actual cars, not simply selling regulatory credits to other auto companies, something previously used to criticize Tesla’s strong financial position, as CNN notes.

Part of the reason we didn’t see a subsequent jump in Tesla’s stock price is because many of the issues plaguing the auto industry as a whole — pandemic-induced supply chain woes, chip shortages most of all — will also affect them for at least the rest of the year. And anyway, for investors looking for the newest and shiniest buy, Tesla may just be old hat.

In the last week alone, two hyped-up electric vehicle startups made their stock market debuts, and another, one of the most exciting in the space, is reportedly planning an IPO later this year. Everyone is looking for the new Tesla, so are these companies it?

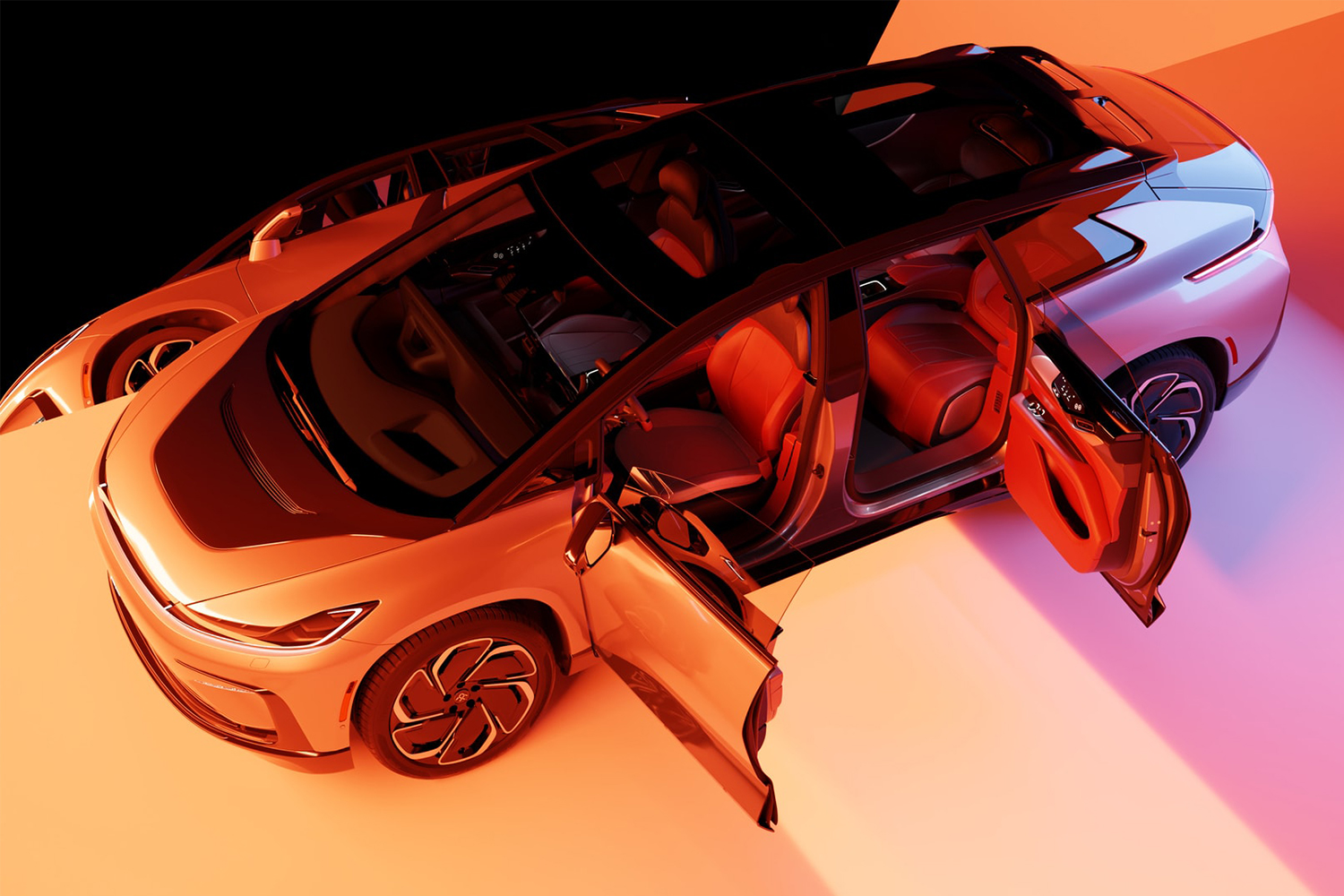

A lot of people seem to think so, but there’s one big problem. The startups in question — Lucid, Faraday Future and Rivian — all have one thing in common: their electric vehicles don’t actually exist yet.

OK, yes, they exist in the sense that all of these companies have produced working vehicles; prototypes of the Lucid Air sedan and Faraday FF 91 SUV have been reviewed by media outlets, and Jeff Bezos drove in the Rivian R1S to his lil’ space vacay. But we’re talking about stock market listings for companies that theoretically sell cars to customers. None of these startups actually do that, at least not yet.

Now, I can already hear the apologists, the stock market is speculative by nature, and always forward-looking, so what’s wrong with investing in speculative companies with promise? That would be a solid argument, if we hadn’t already lived through a number of high-profile EV startups that racked up Tesla-level gains only to crash and burn in spectacular fashion.

First, there was Nikola, which was previously valued at a high of around $26 billion last summer, and was planning to partner with GM on an electric pickup called the Badger; it crashed when fraud claims surfaced, after which the Badger was canceled, the founder quit, and investigations were launched by the SEC and Justice Department (and still continue to this day). Then there’s Lordstown, which you’ll remember as the startup behind the electric Endurance truck touted by former President Trump; shortly after he left office, the company’s stock tanked in part due to claims of fraud from the same investment research firm that came out against Nikola, and now they are being investigated by, you guessed it, the SEC and Justice Department.

Neither of these companies had sold any cars, both of them hit the stock market not through traditional avenues but through the questionable method that is the special purpose acquisition company (or SPAC), and they surged in value for no reason during the pandemic only to hit the brick wall of reality.

Now, both Lucid and Faraday Future are following in those exact same footsteps. Yes, the companies each have their own merits and faults, but they both have exactly zero sales, they used SPAC mergers to get to the stock exchange, and now investors are debating whether or not they’re good buys. (What’s that saying about people who do the same things over and over again expecting different results … ) You could point to Rivian as a more stable bet. The EV truck and SUV company is backed by heavyweights like Amazon, Ford and BlackRock and is reportedly looking to do the work that goes into an initial public offering, but they’ve also delayed the launch of their EVs multiple times. They’ve got preorders, sure, but deliveries have not yet begun.

Until these companies start tallying real-world sales, not just ephemeral preorders, there’s absolutely no reason to believe any of them is the next Tesla, and all the reason in the world to believe they’ll disintegrate just like their predecessors. Personally, I’m hopeful about Lucid and Rivian in particular, but hope doesn’t power our EV future.

Of course, where there’s potential money to be made people will always fork over their own cash in hopes of a windfall. As for me, I’m more interested in the climate-crisis-averting technologies that are more realistic, even if they’re not as sexy as electric adventure vehicles.

This article appeared in an InsideHook newsletter. Sign up for free to get more on travel, wellness, style, drinking, and culture.