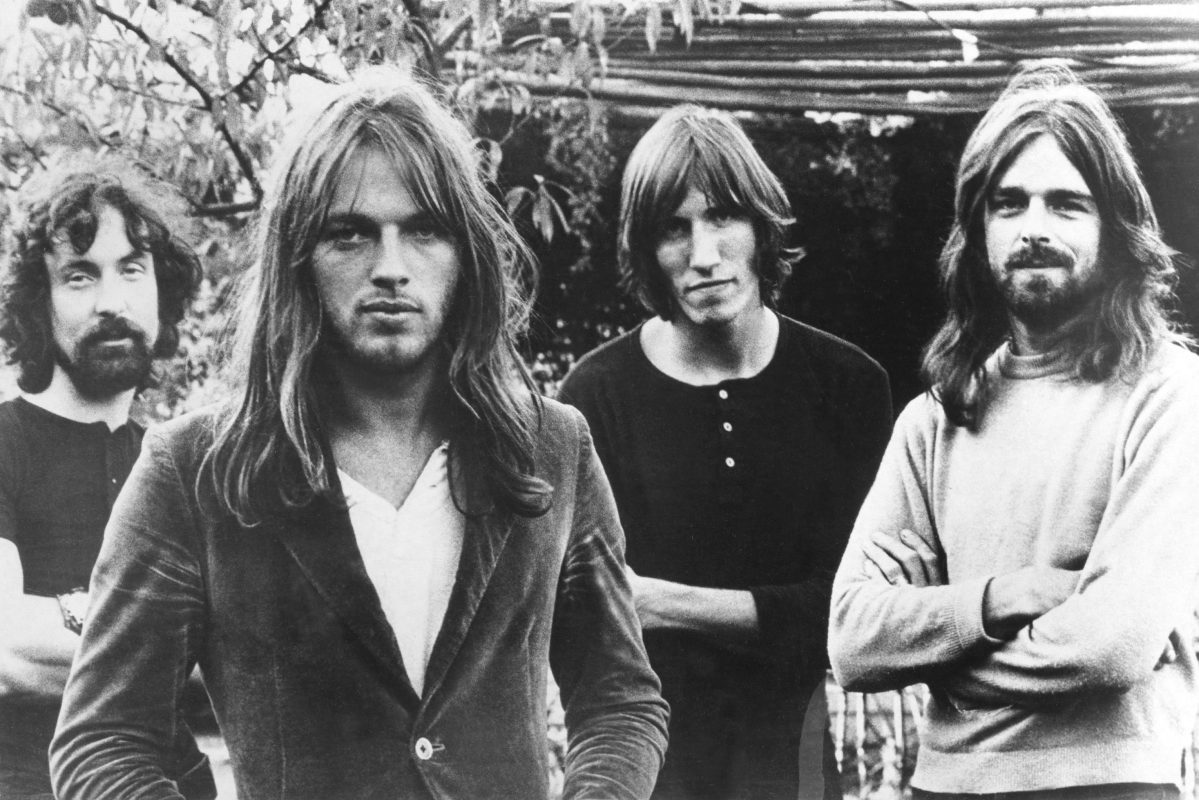

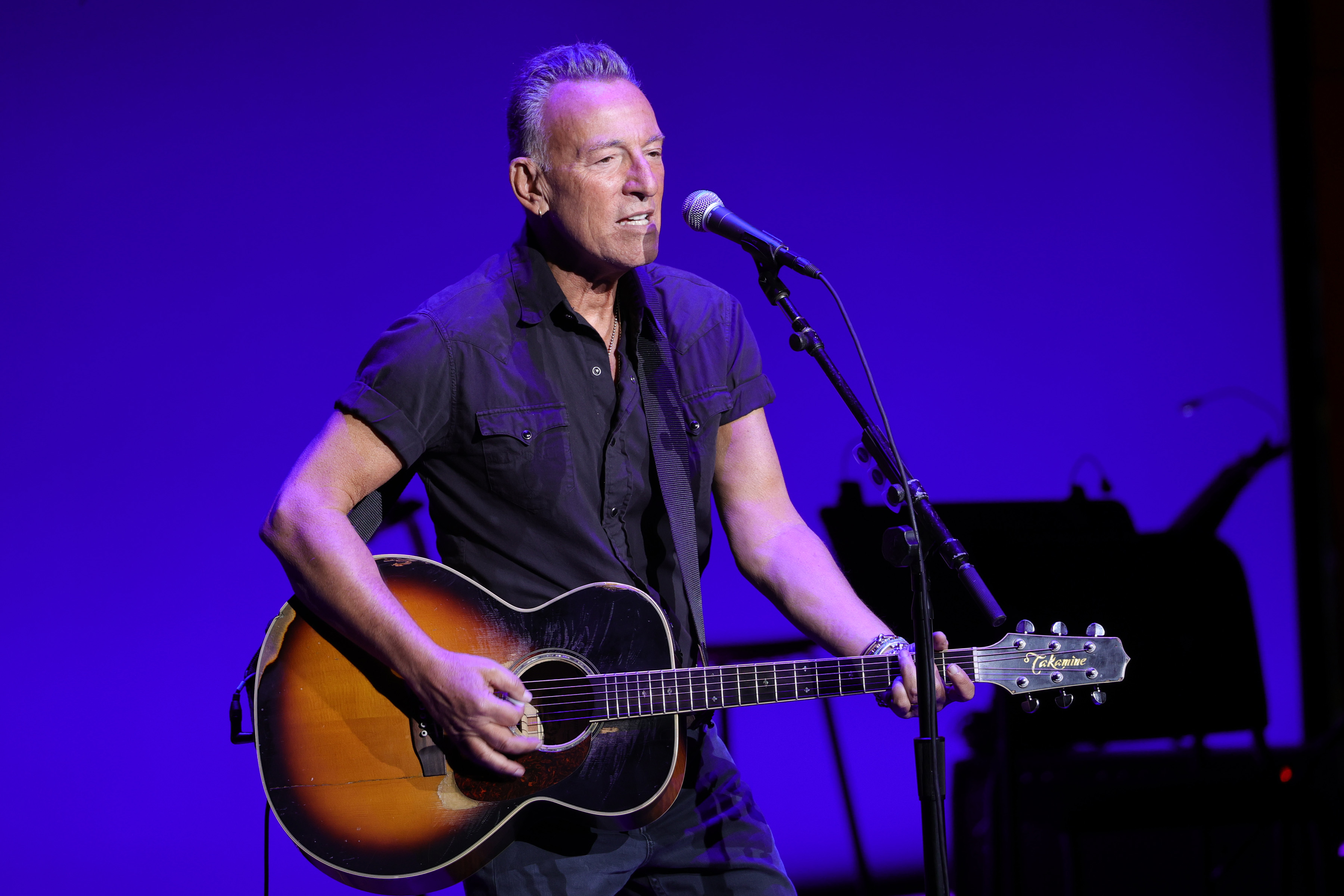

It’s become commonplace these days for classic rock legends to cash out by selling their back catalogs. Bob Dylan sold his entire songwriting catalog to Universal in 2020 for upwards of $300 million, and the following year Bruce Springsteen made history by selling his entire body of work for a whopping $550 million. Tina Turner, David Crosby, Neil Young, Paul Simon and Stevie Nicks have all struck similar (if slightly less lucrative) deals. So should we care that Pink Floyd are poised to follow suit?

Perhaps not, but this one does potentially raise some eyebrows given that, per Reuters, private equity firm Blackstone is among several bidders looking to purchase the British band’s back catalog. Citing “people close to the matter,” the publication notes that “the process is ongoing and Blackstone is not close to striking a deal,” but the company is reportedly willing to spend up to £400 million (or roughly $472 million) to secure the rights to the group’s music.

Of course, since nothing’s been finalized, it’s entirely possible that the band will opt to sell its catalog to a buyer that doesn’t fly directly in the face of everything it stood for. But it’s a little tough to stomach the hypocrisy of a group that railed against corporate greed on tracks like “Money” cashing a massive check from a private equity firm. (Kinda gives new meaning to lyrics like “Grab that cash with both hands and make a stash,” no?)

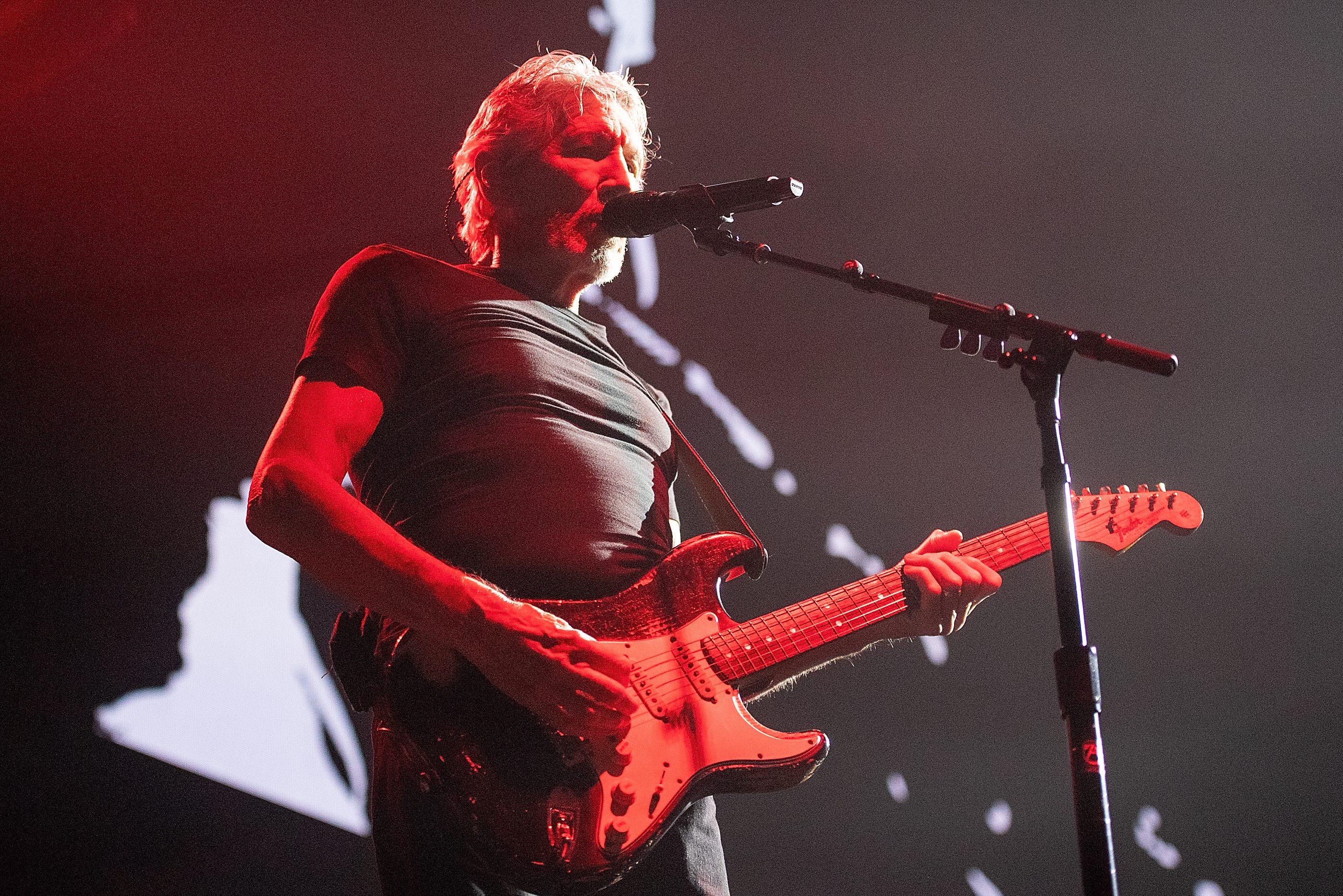

It would be especially galling for Roger Waters in particular to sell out to Blackstone. Waters has been outspoken about preserving the Amazon rainforest, traveling to the region in 2018 and calling out Chevron for polluting the area. Blackstone has been accused of contributing to the deforestation of that very same rainforest. Waters also bragged last year about turning down “a huge amount of money” from Facebook to use “Another Brick in the Wall, Pt. 2” in an ad for Instagram, citing the social media company’s “insidious movement to take over absolutely everything” as his reason for rejecting the deal. Maybe he just hasn’t gotten around to reading up on how Blackstone exploited low-income families and people of color to fuel the global housing crisis in 2008 yet.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.