“Decision science,” popularized by the book and its film adaptation Moneyball, is not a new concept despite its profound applications from investing to politics. You can basically thank the book’s author, Michael Lewis, for the new data-driven research field that he wrote about involving the Oakland Athletics baseball team and its front office’s ability to draft top talent based on statistical analysis.

Given its small team budget, the A’s used one aspect of game theory to find its success. If you’re unfamiliar with the concept of decision science, it’s the application of mathematics to overcome biases and take advantage of opportunities found in lapses of conventional judgment (see below).

Only after the book’s release and the critical success that followed, did Lewis realize that Daniel Kahneman and Amos Tversky, two Israeli psychologists, had devoted their entire professional lives to the field of decision science. “Until that moment I don’t believe I’d ever heard of either Kahneman or Tversky, even though one of them had somehow managed to win a Nobel Prize in economics,” Lewis admitted in a recent piece for Vanity Fair. He continued:

“How did this pair of Israeli psychologists come to have so much to say about these matters of the human mind that they more or less anticipated a book about American baseball written decades in the future? What possessed two guys in the Middle East to sit down and figure out what the mind was doing when it tried to judge a baseball player, or an investment, or a presidential candidate? And how on earth does a psychologist win a Nobel Prize in economics?”

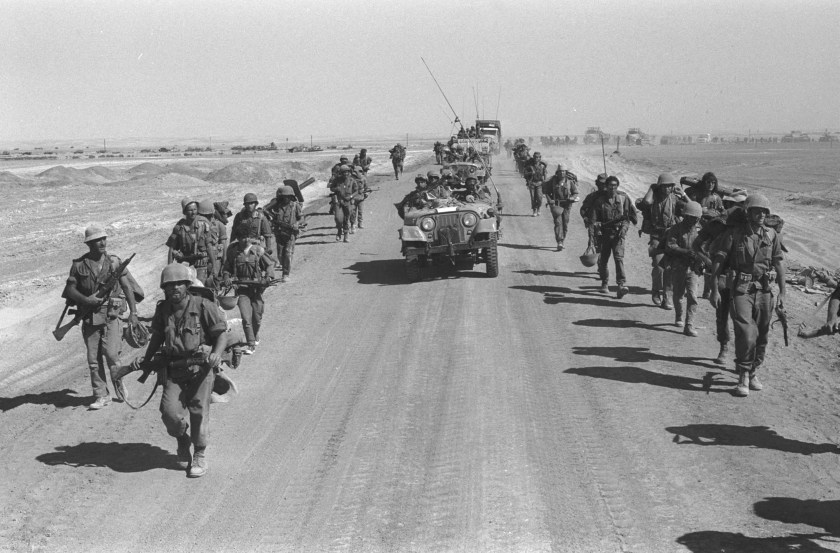

Lewis asks and answers these question in his riveting tale of two men, who were way ahead of their time—and who would later bring their expertise to the Israeli military in the ’60s and ’70s.

The story of Kahneman and Tversky’s groundbreaking project, though, is largely one of a missed opportunity. The two researchers found decision science promising, but thought others would fail to apply it.

To find out why, read the Vanity Fair feature here. Learn how Daniel Kahneman applies decision science to poor financial planning in another video from the psychologist below.

The Charge will help you move better, think clearer and stay in the game longer. Subscribe to our wellness newsletter today.