The collectible asset market — think wine, art and, yes, sneakers — is booming. Why? Maybe because traditional markets, from publicly traded stocks to government bonds to real estate, are kind of boring.

Sure, making money is fun, but nobody wants to hear about how you bought into Tesla at $60 in 2018 and now it’s worth 10 times that. It’s not fun to talk about, and it doesn’t make you interesting. Owning shares in an X-Men first edition or a mint-condition LeBron James rookie card, though? That’s a conversation piece, and it might make you some money in the long term as well.

Nowadays, you can invest in just about anything, with startups popping up in recent years that have created makeshift stock markets for everything from watches to classic cars. The majority of them work on a fractional-ownership model, whereby a company purchases an asset and then breaks it up into shares that you can purchase. Eventually, the company sells the asset and you collect on the increase in value.

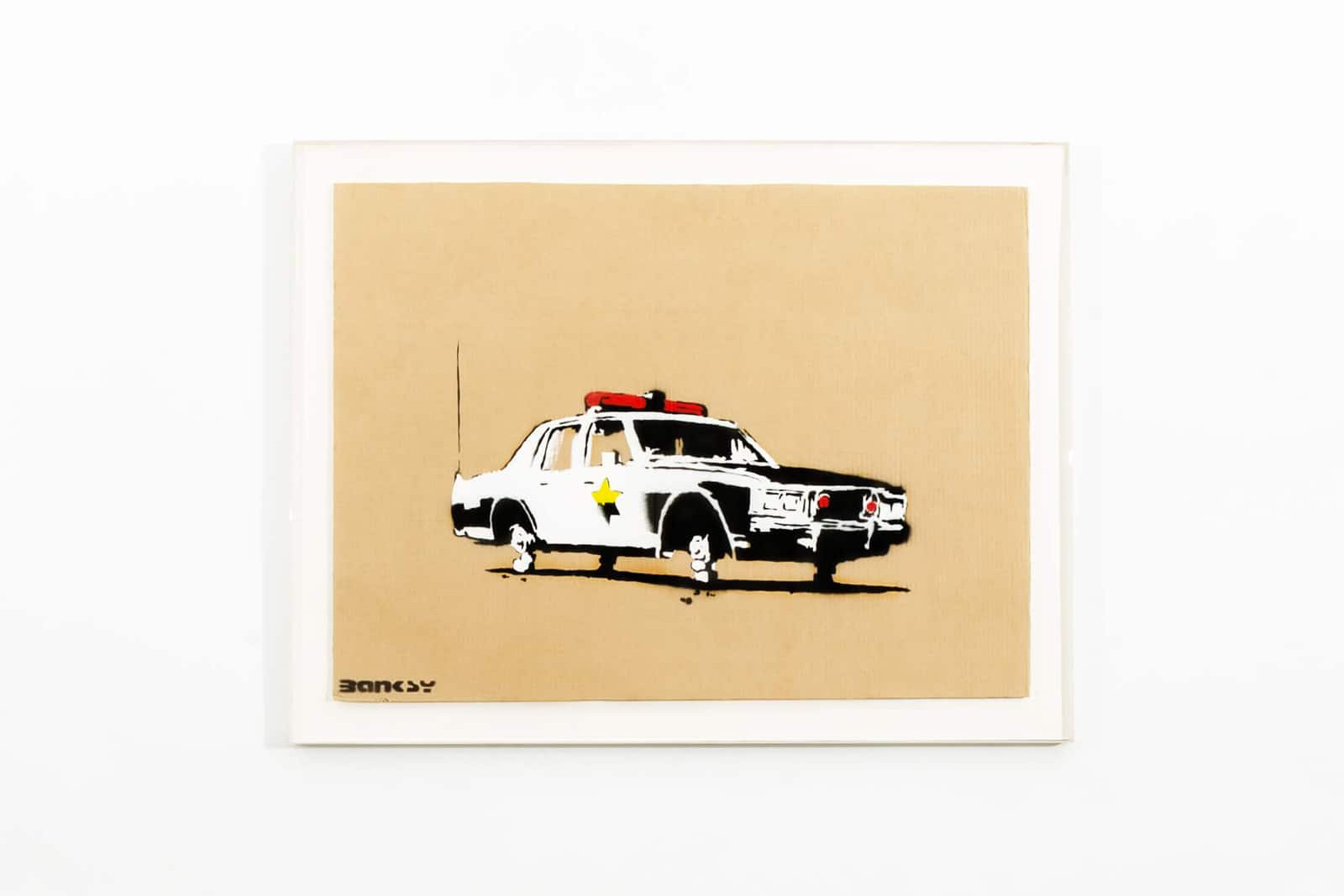

Otis is a company that uses this model. They allow users to invest in what they call “cultural assets”, inviting users to invest in things like the aforementioned X-Men comic and LeBron card, Banksy paintings and the most expensive pair of sneakers ever.

That’d be Michael Jordan’s 1985 game-worn Air Jordan 1 “Shattered Backboards”, which sold at auction earlier in 2020 for a record $560k and then again for $615k. Otis now has those in their possession, and will soon host a makeshift IPO with shares starting at $10 a piece and a total valuation of $700k. Once those shares sell out, they are off the market at that price. Recently, though, Otis conveniently launched a trading platform, so now investors can buy and sell shares in assets at a price dictated by the market. It is, in essence, a stock exchange for cool shit that you would show off to your friends.

This is a fairly unique asset class and can be a bit intimidating, so we dialed up Otis founder Michael Karnjanaprakorn to get his thoughts on how to enter the market in a safe and responsible manner, whether it’s with Otis or one of the many similarly minded platforms that have taken Silicon Valley by storm.

Treat It as a Real Investment Strategy, Not a Trend

“This may sound self-serving, but I really think some new [people] to the space aren’t allocating enough to their portfolios. For an investment on Otis to have any meaningful effect of diversifying your portfolio and participating in upside, you really need to think about it in terms of a percentage of your portfolio as opposed to strictly a dollar amount. There’s no one-size-fits-all answer to this question, but a recent survey of ultra-high net-worth individuals showed that they’re investing about 5% of their net worth into collectibles — more than gold and precious metals, and more than crypto. Obviously that allocation isn’t going to be perfect for everyone, but I think it’s a good place to start in thinking about an allocation that can help diversify your portfolio and have meaningful upside in terms of returns.”

Do Your Research

“Every investment, including those on Otis, have risks associated with them. We highlight these in our investment reports and definitely encourage investors to read them thoroughly. We even have a resources section on our website. Also, for each cultural asset on our platform, we create a detailed report that covers specifics of the asset, risks, as well as a little on the categories that each asset is a part of. Beyond Otis, there are tons of category-specific resources out on the internet. One that I particularly love is this guide to trading cards created by Gary Vaynerchuk.”

Stay Ahead of the Curve

“Dive in and learn a lot about the categories you want to participate in. In the equities markets, prices are, theoretically at least, based on a company’s discounted future cash flows — meaning the money they’re going to make in the future. In the case of collectibles and cultural assets, it’s all about scarcity and demand. And so understanding the catalysts that drive demand is really key. For instance, the Jordan documentary The Last Dance has driven a ton of renewed interest in memorabilia related to Michael Jordan. The success of all the Marvel movies have been huge catalysts in driving up demand for certain comics that feature those characters’ first appearance. Understanding these catalysts can help you be a more effective and informed investor.”

Invest in Timeframes You Are Comfortable With

“With the rollout of our trading platform earlier this year, we’re aggressively pushing to have every asset on our platform available for 24/7 trading, which should make the assets relatively liquid. In terms of time horizon, just like with the equities market, it really depends on the individual investor’s strategy. In the equities markets there are people who hold for the long term and there are people who are buying and selling shares with much more frequency.”

Be Aware of the Pros and Cons of Owning an Entire Asset Yourself

“While [owning assets] has clear benefits (you get to hold on to the asset and look at it whenever you want), you also have to consider the downsides, which are that you have to safely store and insure the asset. And when eventually you want to earn a return, you’re going to have to sell and ship the item as well. While we would never tell anyone not to do that, it’s important that people consider some of these additional steps they’ll need to take before deciding which path is best for them.”

This article was featured in the InsideHook newsletter. Sign up now.