Remember when labels and investment funds started buying up the catalogs of your favorite classic rock heroes and paying ridiculous sums of money? You should, because that was basically all the rage last year (and a bit of this year).

Turns out that might not have been such a great investment. As Ted Gioia of the music newsletter The Honest Broker points out, the British investment fund Hipgnosis — which controls over 65,000 songs and started this music catalog spree in 2018 — has seen its pro forma royalty income from its songs drop for the last two years. As well, the cost of paying off interest from the group’s $600 million in debt is expected to rise.

“Even more worrisome…is the possibility that Hipgnosis will need to write off some of the book value of its song catalogs,” writes Gioia. “This could seriously impair the fund’s ability to borrow in the future because its creditworthiness depends ultimately on what this music is actually worth.”

The investment group hasn’t bought a song in a while and even took charge of $1.6 million over a six-month period for “aborted deal expenses.” Gioia suggests that Blackstone, one Hipgnosis’s main financial backers, may buy the company in the near future for a steep discount.

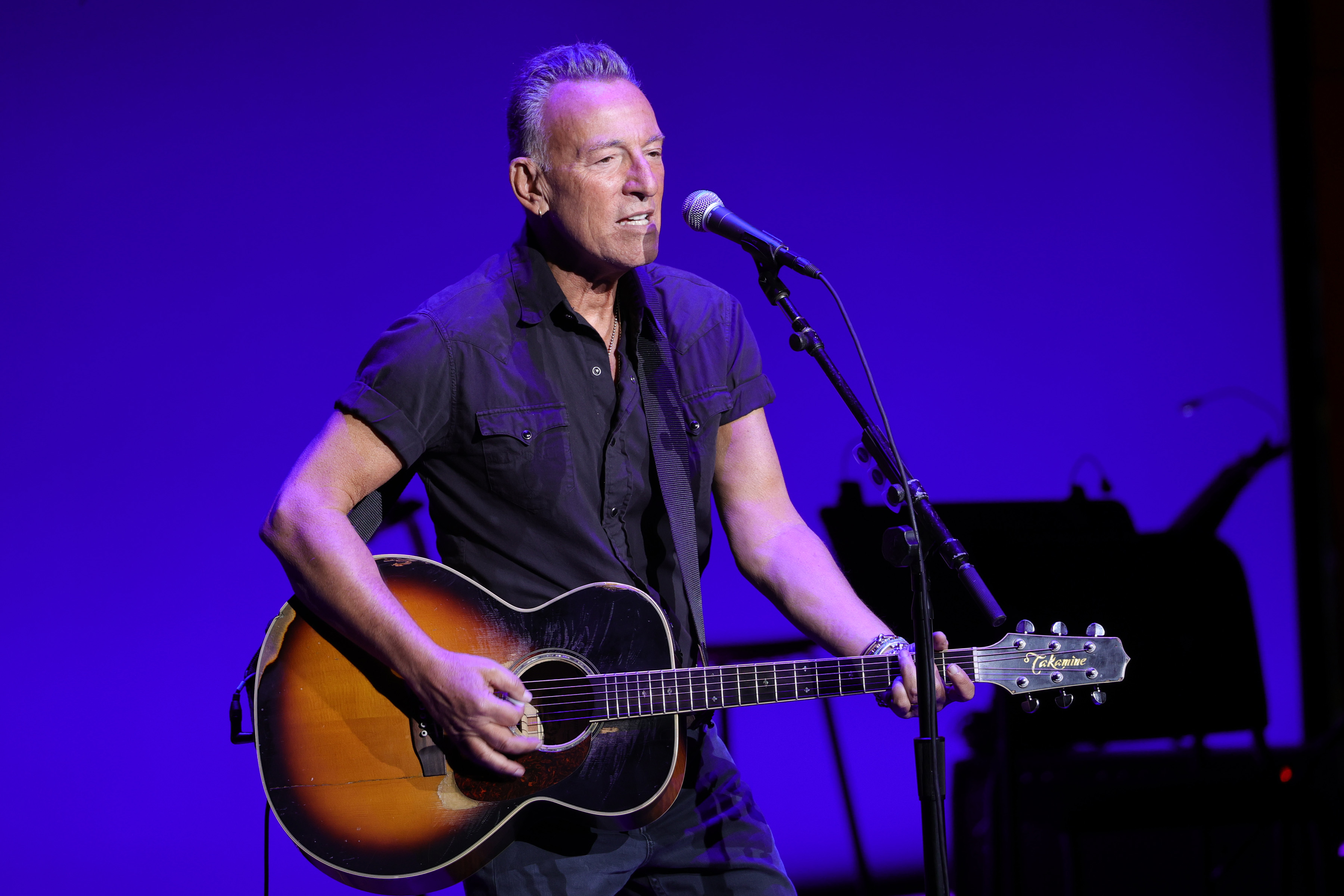

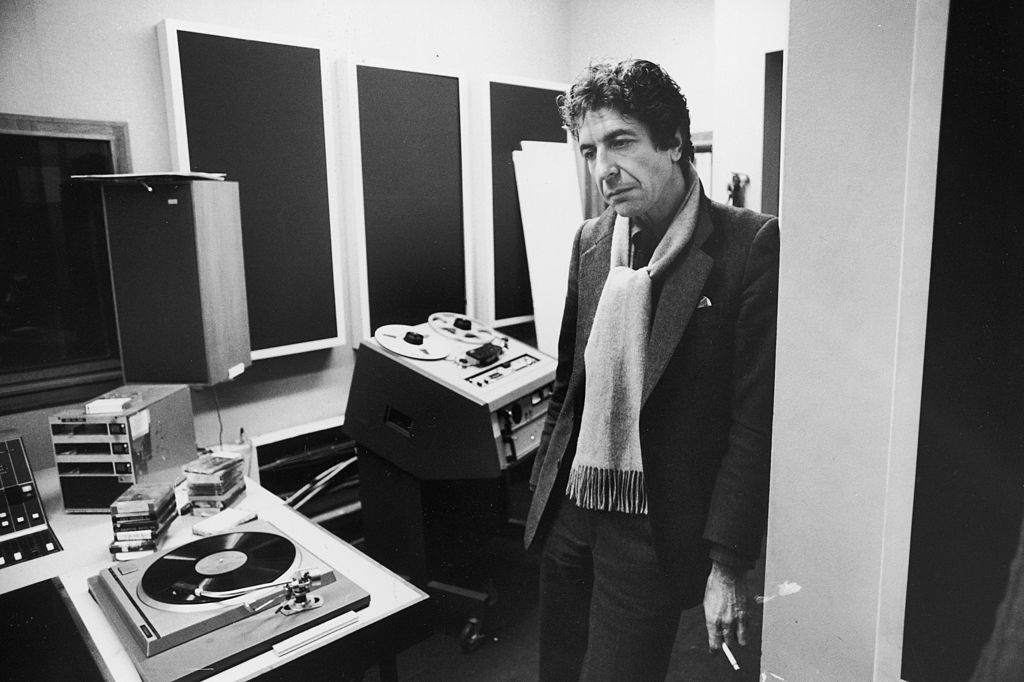

So the days of older musicians selling their catalogs for exorbitant prices may be coming to an end (which might include a rumored $500 million deal for the rights to Pink Floyd songs). And sinking value is not only going to affect Hipgnosis but labels like Sony and Universal, which spent millions on the catalogs of Bruce Springsteen and Bob Dylan — and not necessarily to make a profit. As David Chidekel, a partner at Early Sullivan Wright Gizer & McRae LLP, told InsideHook last year regarding these deals: “The company paying the ridiculous amounts of money has a strategic need to have that particular thing, because they know with that particular thing, they can sell their company for a ridiculous amount of money to somebody else.”

And if that perceived value has severely decreased? Then that ridiculous catalog deal is gonna look even worse.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.