As the tradition of having the bride’s parents take on wedding costs fades into history, millennials are instead opting to go into debt to pay for their big day.

The average American wedding now costs $39,000, often featuring decadent Pinterest-inspired attractions such as cigar bars, candy buffets and photo booths. A new branch of personal debt known as nuptial loans average over $10,000.

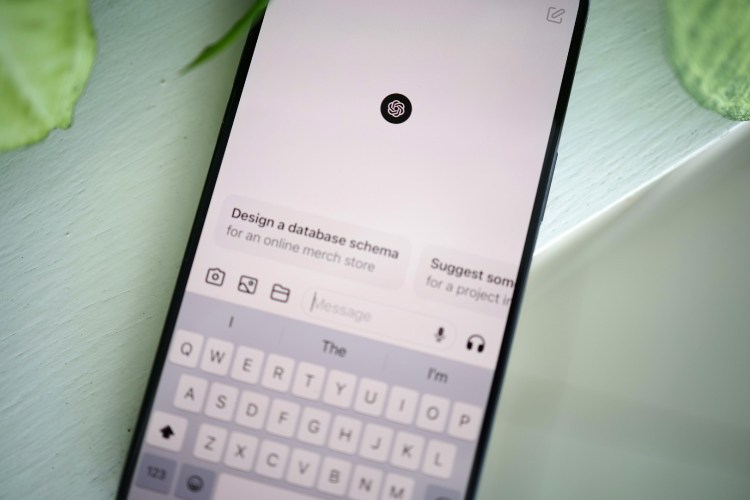

Virtual lending marketplace Upstart promises an average wedding loan of $11,000 for a three-, five- or seven-year period, with the annual percentage rate fluctuating from anywhere between 5 and 56 percent. To determine an applicant’s ability to pay back the loan, the online lender utilizes much more than credit scores. The lending company uses artificial intelligence to determine an applicant’s ability to pay back a loan based on factors such as education, area of study and job history.

Earnest, another loan provider, boasts the tagline “Inspired by Pinterest? Make it happen with low interest” to appeal to couples seeking an Instagram-worthy ceremony. Online lender Prosper offers engagement ring financing and extra honeymoon cash.

Yet, experts say that wedding loans are more of a PR play rather than a new product, with lending companies rebranding unsecured personal loans to 20- and 30-somethings. Critics are urging young couples against overpriced social media-inspired receptions and taking on more debt than they can handle.

Editor’s Note: RealClearLife, a news and lifestyle publisher, is now a part of InsideHook. Together, we’ll be covering current events, pop culture, sports, travel, health and the world. Subscribe here for our free daily newsletter.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.