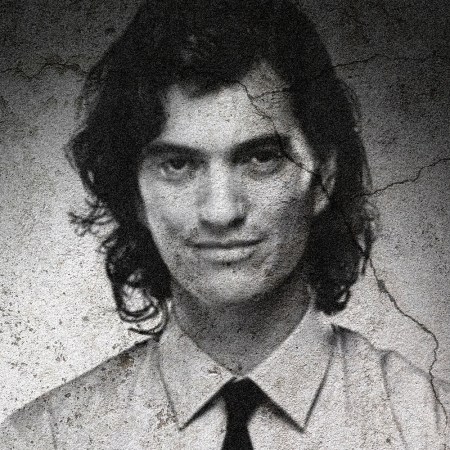

In the wake of a recent unflattering Wall Street Journal profile and a botched public offering, WeWork CEO Adam Neumann has stepped down under pressure from board members and investors like the Japanese company SoftBank, according to the New York Times.

Neumann will reportedly become non-executive chairman of WeWork’s parent, the We Company, while Sebastian Gunningham and Artie Minson will serve as interim co-chief executives while WeWork searches for a permanent replacement for Neumann.

According to the Times, the decision was made during a “lengthy board call” on Tuesday (Sept. 24). Board members and investors were said to be concerned about Neumann’s impulsive management style, which resulted in decisions like banning meat from the company and bringing in tequila shots and Run-DMC after a round of layoffs in 2016.

The company has also been bleeding money under Neumann. Back in August, it was reported that WeWork lost $429 million, $883 million and $1.6 billion in 2016, 2017 and 2018, respectively. Earlier this month, the company was valued at $15 billion — significantly less than the $47 billion valuation it sold shares at privately in January.

As the Times notes, “Investors have expressed concern that Mr. Neumann, a charismatic but unpredictable leader, exercised too much control over the company through special voting shares. They were also unnerved by deals We Company reached with Mr. Neumann and entities he controlled.”

Subscribe here for our free daily newsletter.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.