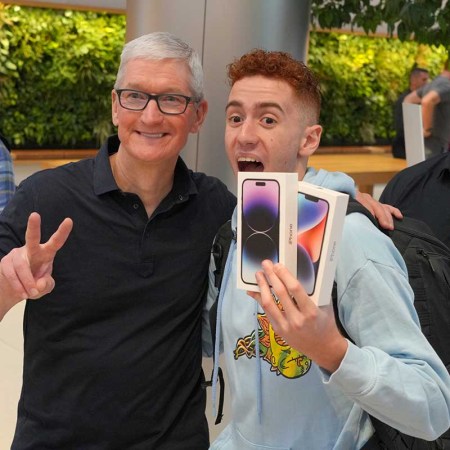

Looking for a new Apple feature to invest your money in? Now you literally can. Yesterday, Apple announced a new high-yield savings account with a 4.15% annual percentage yield in partnership with Goldman Sachs. This is more than 10 times the national APY average, according to Apple.

Basically, the cash back you earn from using your Apple Card, also known as Daily Cash, can be put into a savings account and managed in the Apple Card Wallet. It’ll be automatically deposited into the account, and it has no fees, minimum deposits or minimum balance requirements.

Would You Buy a Car From the Company That Builds iPhones?

Foxconn, which manufactures phones for Apple, just launched its first electric vehicleApple also said users can deposit money from other bank accounts or their Apple Cash balance into the savings account, and there’s no limit to how much Daily Cash you can earn. Everything can be tracked and managed in a new savings account dashboard feature in the Wallet app.

And while this all sounds glamorous, be wary: Apple also said the APY is subject to change at any time, and there are maximum balance and transfer limits. Apple Cards are also only subject to qualifying U.S. applicants subject to credit approval.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said in a press release. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.