Who and where are the super rich, and how were they spending their money last year?

That’s what the 15th edition of The Wealth Report 2021 aims to answer. A collaboration between global real estate consultants Knight Frank and the American real estate company Douglas Elliman, the annual survey charts the number of ultra-high-net-worth individuals (UHNWIs) — people with $30 million or more — and their spending habits.

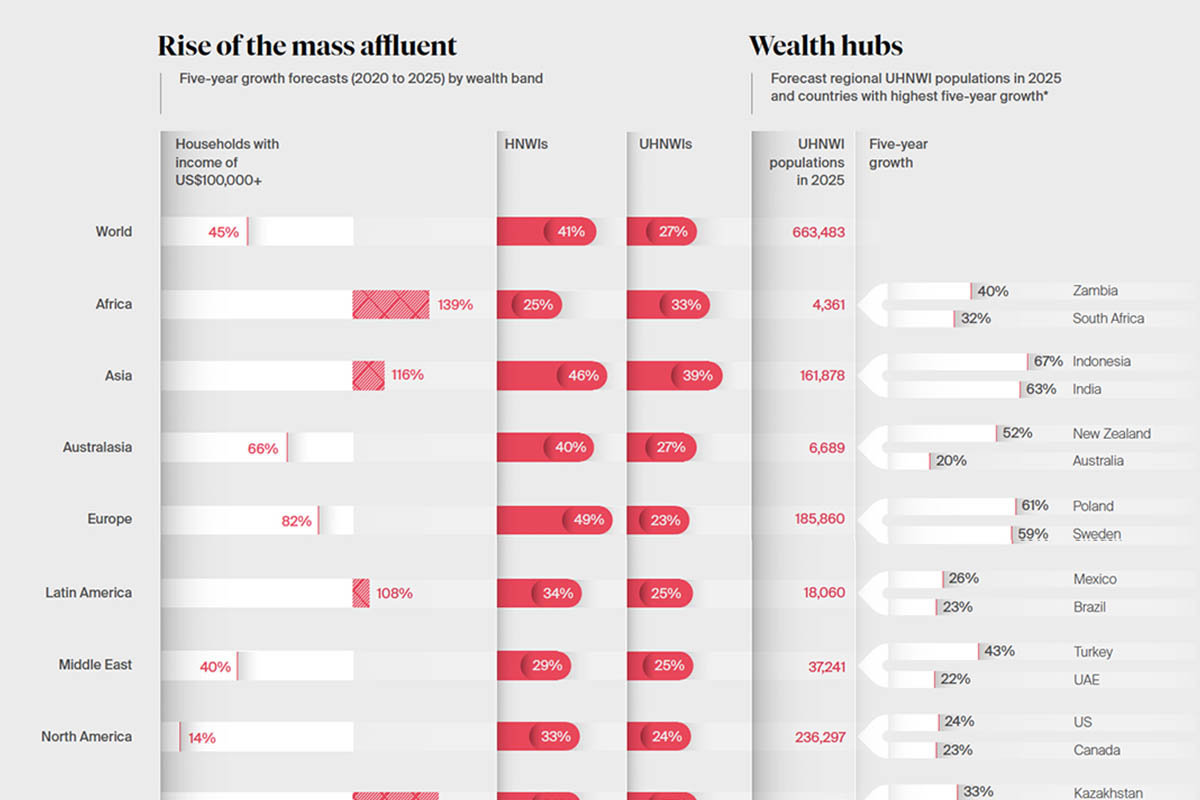

As for the UHNWIs, that segment is predicted to grow by 27% in the next five years to 663,483. Indonesia, India, Poland and Sweden are some of the countries expected to see the most growth in super wealthy individuals. As well, the number of millionaires is expected to rise by 41% over the same period of time.

“Although COVID-19 is still far from under control in many parts of the world, the forecast growth in the number of UHNWIs globally over the next five years represents optimism for the emergence of a new economic cycle and sets new expectations for the post-pandemic world,” said Flora Harley, deputy editor of The Wealth Report at Knight Frank.

Some other key findings:

- The pandemic supported the wealthy. With lower interest rates and more fiscal stimulus, asset prices surged and drove the world’s UHNWI population 2.4% higher over year to more than 520,000.

- Wealth managers and private bankers believe increased income inequality will “fuel demand for policies aimed at curbing imbalance” in most countries.

- UHNWIs are increasingly looking to get a second passport; that activity saw a whopping 50% growth in just a year.

- New York still leads the world in UHNWIs, but if you lower the bar to mere millionaires, London would tie in the report’s City Wealth Index.

- As for where these rich types are putting their money: When it comes to “collectibles,” the big winners were like handbags, particularly Hermès (+17%), fine wine (+13%) and classic cars (+6%). Not so hot markets in 2020? Rare whisky (down 3.5%) and colored diamonds (no gain), although both seem pandemic-related and looking to rebound.

And if you’re wondering where the UHNWIs are moving to, check out Barcelona. The report spends several pages touting the city’s superyacht marina, Michelin-starred restaurants and urban sustainability plans.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.