Editor’s Note: RealClearLife, a news and lifestyle publisher, is now a part of InsideHook. Together, we’ll be covering current events, pop culture, sports, travel, health and the world.

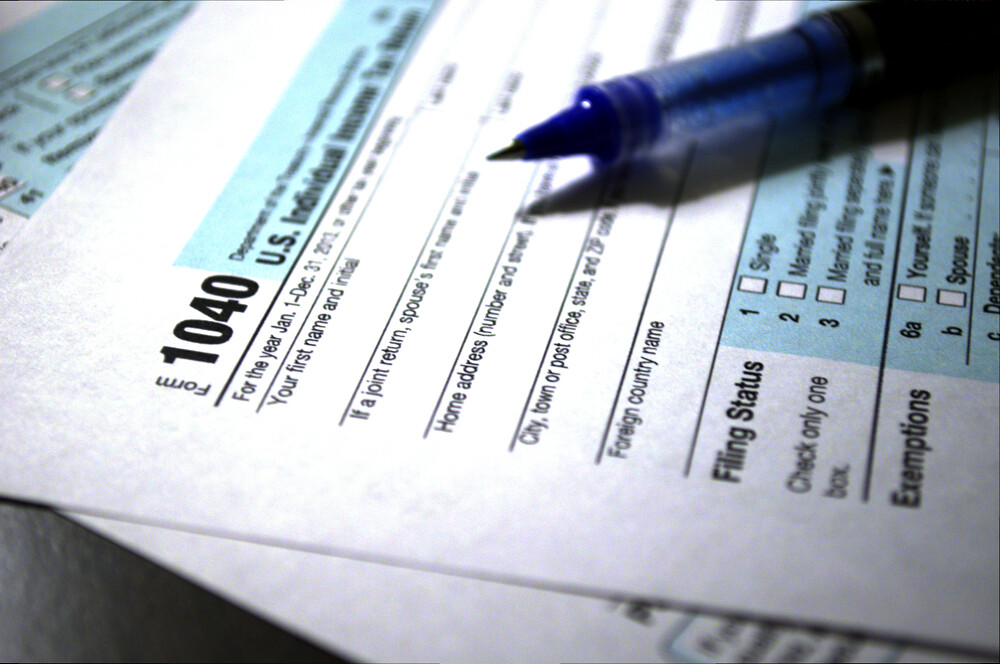

Could universal public disclosure of personal tax returns be the radical transparency cure that our democracy needs right now? Some advocates argue that making everyone’s 1040s freely available could act as a powerful deterrent against fraud and make it easier to identify politicians who are acting out of their own interests, rather than their constituents.

While the idea of allowing everyone pore over your tax returns to see how much you make—or don’t make—might sound far-fetched today, it does have some precedent. In 1924—barely a decade after the 16th Amendment established income taxes—the federal government opened up everyone’s income tax returns for public perusal. The move ignited a frenzy of curiosity seekers. The wealthy hated it, however, and the law was rescinded soon after.

But this view of universal tax disclosure didn’t die. In fact, it remains the law of the land in the Scandinavian countries of Norway and Finland. (In the latter, the annual release of the individual tax forms on November 1st is jokingly referred to as “National Jealousy Day.”) Those countries point to the disclosures as a reality check on inequality, and advocates here in the United States say publicizing this data would help to identify and mitigate wage discrimination, make it harder to hide illegitimate sources of income, and enable citizens to better track conflicts of interest among their political leaders.

Still, the question remains: just how much public sunlight are Americans are willing tolerate if it means your neighbors can finally know how much you really make?

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.