After hemming and hawing about it for several years, and despite a backlash from existing owners upset by the prospect, the future of automotive retail is finally here. A growing number of automakers, including both luxury luminaries like Mercedes-Benz and BMW and mainstream brands such as General Motors and Ford, are expanding plans to make certain vehicle features available by subscription only.

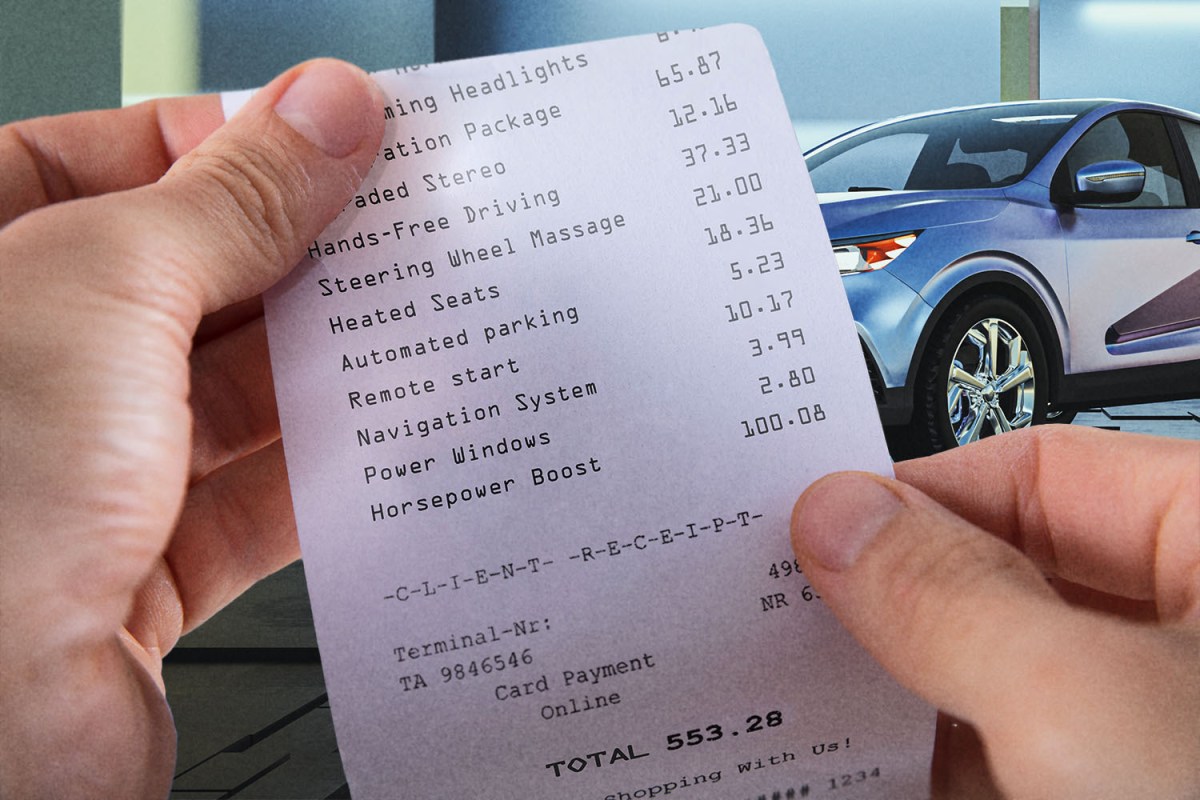

This means that, on top of signing up for regular payments on satellite radio or online concierge services, owners will be expected to open up their wallets on a pay-as-you-go basis to access features such as automated parking, or unlock additional horsepower from the drivetrain. All of which, of course, is over and above the standard monthly lease or purchase payment that used to bundle all of an automobile’s equipment together at the time of sale (and amortize it out over the course of the contract).

We don’t need to tell you that subscription fatigue is a real thing. Whether it’s paying for a growing list of streaming services at home or re-upping on software suites at the office, no one is eager to add yet another recurring payment to their credit card every month. However, there are a number of other, equally troubling dimensions to this particular subscription scheme, which are poised to have an even greater impact on the automotive market, and raise important questions about what the future will look like for dealers, manufacturers and customers alike.

How Important Is Car Ownership, Really?

There are two perspectives to take when examining the broad question of luxury car ownership. It’s clear that a significant population of premium-badged cars are leased, not bought, by their drivers. This strategy is particularly prevalent among lower-to-mid-range SUVs and sedans where owners are trying to maximize the prestige return on their monthly payment, and would seem to suggest that in terms of selling feature subscriptions to its primary clientele, automakers are playing to a receptive audience.

That being said, zooming in on the previous attempt by high-end brands to further monetize the lease-friendly cohort buying its cars reveals an almost total business failure. Companies as diverse as Porsche, Cadillac and Volvo have, over the course of the past several years, launched full-vehicle subscription services where drivers could take home a rotating range of cars and SUVs in exchange for a single monthly payment (that was often significantly more expensive than a standard lease contract). Despite many of these initiatives also bundling maintenance and insurance into their price tag, uptake was tepid at best, with most programs restricted to a few urban centers or shuttering their doors shortly after being launched.

The split seems clear. Value-conscious entry-level buyers are keen to lease a luxury badge, while those who can afford a six-figure automobile largely reject both subscriptions and leasing in favor of outright purchases. Will a similar fork be reflected by feature subscription uptake? If so, then companies like Mercedes-Benz, with its plan to offer more power in its six-figure, flagship EQS sedan and SUV for a $1,200 yearly charge might not find the necessary traction.

Everything You’ve Wanted to Know About Installing an EV Charger in Your Home

Is it expensive? Safe? Convenient? Here’s what I learned after hooking up the Pulsar Plus from Wallbox.What Happens to Residual Values?

Residual values are a key component of any modern lease model. This number represents the projected value of a vehicle at the end of its leasing period, and it’s used to help calculate the cost of a monthly payment. Models with high residual values typically feature more modest lease payments because dealers know that they can cash in by selling the car, truck or SUV a second time after it has been returned. Lower residual values jack up lease costs to cover the predicted shortfall at the end of that same term.

Given the lease-heavy business model employed by many luxury brands, the concept of subscription-based features throws a simian-shaped wrench directly into the works of calculating what an automobile will be worth on the secondhand market. Will it be necessary to adopt a two-tiered residual outlook, where one represents the value of the vehicle with all features subscribed and functional, and the other pricing it out in a hobbled, low-equipment state? And which of these residuals will the leasing party pay for each month?

Then there is the question of downloadable features that aren’t subscription-based. For example, Polestar has introduced the option of purchasing additional horsepower for the Polestar 2 in the form of an over-the-air upgrade for a one-time fee. If this vehicle is returned after a lease, or traded-in to a dealership for a new model, does the extra grunt go with it? Does the owner get to keep it and move it over to their new vehicle? Or is the next buyer charged a second time for the same upgrade?

The farther you get from the initial purchase, the more muddied the waters become. It’s conceivable that we are about to enter a world where discovering or even testing which equipment is functional and which isn’t on a used vehicle will become a frustrating chore. This doesn’t just complicate the lives of sellers and buyers as they attempt to negotiate a morass of subscription transfers and terms of service, but it also brings to bear the real threat of tarnishing a brand’s reputation, which further drags residuals and reduces overall interest among potential customers.

Where Do the Subscriptions Stop?

If heated seats can be sold on a subscription basis, is there any feature inside a vehicle that can’t? Power windows, stereo speakers, self-dimming headlights — pretty much anything outside of basic vehicle functionality and the leather on the seats is fair game for software controls that only activate when the next scheduled payment has cleared.

Subscriptions also happen to be the perfect Trojan horse for automakers looking to charge a recurring premium for more advanced equipment. It’s already happened with systems like Ford’s BlueCruise, a Level 2 adaptive cruise control feature that charges customers every three years for the right to use it. The same is true for General Motors with its similar Super Cruise feature after an initial trial period.

The decision to make adaptive cruise control technology like Super Cruise and BlueCruise part of a subscription package may be the inflection point that gets federal regulators involved in reigning in automaker avarice. Long considered to be part of an automobile’s safety systems, which are increasingly legislated as standard equipment even on affordable models, it’s conceivable that features designed to protect pedestrians, passengers and other motorists might slip out of the subscription loop.

The 6 Best Bells and Whistles We Found on Cars This Year

Sometimes the most useful features aren’t the flashiestHow Big Does the Hacking Grey Market Get?

Any time an industry makes a move that segregates customers by way of digital controls — such as during the satellite TV boom, or carrier-locked mobile devices — a parallel market emerges for overriding these very same restrictions.

In some cases (most recently with phones) the restrictions imposed by manufacturers or service providers were deemed to be so onerous that they were overturned by legislation that legalized the rights for consumers to escape their clutches. In others, concerns about right-to-repair closed-system technologies lead to requirements that companies provide access to software platforms, including wireless vehicle telematics.

In the meantime, however, a grey market almost always emerges. It consists of hackers who are willing to alter factory code in order to improve performance, escape online shackles or expand the feature sets of a given product. This leads to a different source of pressure on companies already dealing with grumbling customers and regulatory investigation.

It’s a very short conceptual leap from hacking a cell phone to work on your carrier of choice, to installing a new set of software that boosts the performance of an EV or activates a heated steering wheel. Moving past the morality of paying a third-party shop to expand a vehicle’s features list, there are warranty questions to be considered, as well as the investment an automaker will have to make in playing cat-and-mouse with hackers eager to make an end-run around its software security protocols. Throw in futzing with features that are tied to mission critical safety equipment (such as BlueCruise and automated braking, for example), and the issue moves beyond dollars and cents and into life and death.

What Happens When Tech Ages Out?

The last concern facing the subscription feature concept is largely out of car company control. The inevitable march of forward progress dictates the technologies that are cutting edge today will be left behind at some point in the future. This makes it a certainty that some of the tech used to underpin vehicle subscriptions will no longer be viable after a certain number of years.

The impact of progress on subscription-based business plans is best demonstrated by the impact that the 3G network phase-out had on automobiles built over the past decade and a half. Although no longer needed by modern mobile devices (with 4G and 5G handling the bulk of communications), 3G was crucial to telematics systems from a long list of brands. Specifically, services like crash reporting, emergency services (SOS) features and remote vehicle diagnostics are no longer able to send out a signal in the absence of a 3G network. While some companies were able to stave off problems with software updates, others required new hardware or offered no solutions at all.

There is no guarantee that the silicone chips and remote access antennas that make vehicle feature subscriptions possible today will still be functional in five to 10 years time. This window is mostly outside of the service intervals maintained by major brands, and in view of the lack of interest displayed in dealing with the 3G mess, it also appears to be a low priority for corporate planners. Given that the average age of a vehicle on American roads hovers at just over 12 years, however, it’s certainly a consideration for owners unlikely to become return customers should they suddenly get cut off from the systems and options they’ve been dutifully paying for over the past decade.

This article appeared in an InsideHook newsletter. Sign up for free to get more on travel, wellness, style, drinking, and culture.