Having budget issues? Maybe you need a financial therapist.

Which is a thing, and possibly (depending on your finances) as important as any type of therapist in your life. “Financial therapy is a new and developing field of research,” says Dr. Megan Ford, a certified family therapist who has a Ph.D. in financial planning and served as the President of the Board of Directions for the Financial Therapy Association. “It’s been around 10 years but really flying under the radar. We see more and more people coming to terms with the emotional side of money. Compound that with all the financial stress that people are experiencing now, and it’s becoming more common in the vernacular.”

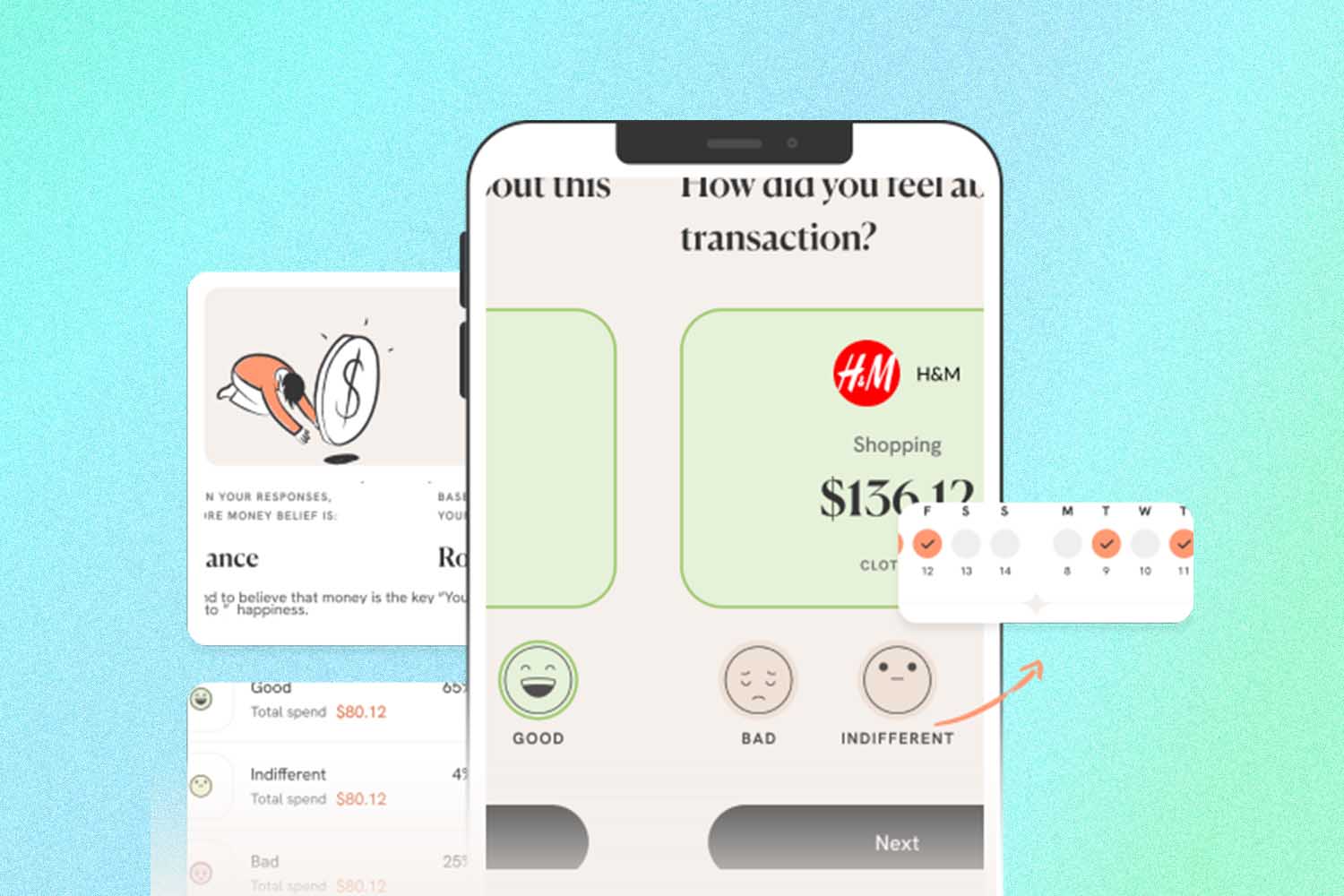

Dr. Ford is part of the team behind Stackin, a different kind of personal finance app that relies more on research from cognitive behavioral therapy and finance professionals than on spreadsheets. It’s the kind of app that’ll ask you about your financial intentions, have you rate your spending habits on how you feel and ask for daily check-ins so you can reflect on your relationship with money.

This type of money journaling can be just as important as simply setting a budget. The goal of the app is to “understand and improve your relationship with money through therapy-based exercises and coaching” — to that last part, there is a team that’ll text or chat with you regarding purchases and the guilt (or lack thereof) you might feel after spending money. (It’s 2023 so I sadly have to add that this “team” at Stackin is human and not some sort of AI chatbot.)

Why You Should Get an E-Will, Even If You’re Young

With some exceptions, estate planning can be as easy as doing your taxes online“Fundamentally what we’re trying to do is help people ‘stack’ positive habits and behaviors,” explains Sam Garrison, Stackin’s co-founder and president. “A lot of Stackin’s kind of journey is very tied to my own journey, so I’m pretty tied into our users.”

Stackin is focused on people from about 22-35, or people entering or in the workforce who hit an “inflection point.” Says Garrison: “That’s the point where we see our users, as people who are suddenly in a relationship, or having a change of career or where something happens when they all of sudden go from ‘I can live in the present’ to ‘hold on, I wanna move in with someone or move across the country, and I have to figure out how to hold on to money.’”

A main issue with most financial apps is that they assume consumers are, well, rational. “Part of the reason Stackin exists is that these aren’t unemotional decisions you’re making. If it was that easy we wouldn’t be here,” says Garrison.

Dr. Ford hopes the app refocuses people on the meaning of money in their lives and aligning their behavior and values with their finances. “Are we really living the way we want to be living? And are we happy and satisfied with that? This gives you an opportunity to step back and think,” she adds.

The best part of Stackin, for me, is that it’s not about shaming users into saving money. My initial financial assessment from the app was that “I tend to believe that [I] can never have enough money” and Stackin suggested I “hoard” money as a way of protection, control and security. The app then recommended a series of coaching sessions called “Introduction to Money Protection” (available as both an article and an audio coach).

Basically, it nicely said I was a bit of a tight-ass with finances. So it was nice to have financial advice that said it was ok to live a little…as long as it’s about spending money on something I truly care about.

“People spend money in a way that is kind of misaligned with what they actually want,” says Garrison. “For example, you pay for a gym membership that you never use, but actually the thing that would make you happy is taking a trip. So it’s more about trying to shift that behavior.”

A quick review of Stackin as someone who’s been using it for two weeks: It’s not for me, but only because I fall outside of the core demographic (e.g. it didn’t have an option for me about saving for retirement). It was interesting to rate, emotionally, how I spent my money (the app will ask you for permission to tie into your bank and credit cards to track purchases, which does make it easier than journaling everything you buy individually). I learned a fair amount about my habits and how I react to different types and amounts of spending. I would have preferred if the app was a bit more proactive: I didn’t get prompts for my daily check-in, so — much like any therapy — you’re only going to get out of it what you put into it. You’ll have to make an effort to go to the app every day, something that even Garrison admits he doesn’t always do (as Dr. Ford notes, we’ve been raised to not talk about money.)

At $45 per month, Stackin isn’t cheap, though it’s certainly an acceptable amount if you have a damaging or unhealthy relationship with money and want to improve. And like any therapy, you may have a point where you’ve reached a place where you can move on…or not.

“Even as someone in my position, my role who eats, drinks, sleeps financial therapy, financial wellness, there is so much more and it’s this constant sort of evolution of knowing yourself,” says Dr. Ford, when asked what she’s learned from using her own app. “I’ve learned that for me, there’s a long way to go.”

This article appeared in an InsideHook newsletter. Sign up for free to get more on travel, wellness, style, drinking, and culture.