What’s worse than renewing your passport only to be denied? Getting a bill from the IRS with your rejection slip.

That’s essentially what’s happening to at least 362,000 Americans, as the IRS and State Department have begun to work together to deny passports to people with overdue taxes.

Why that number? Under the Fixing America’s Surface Transportation (or FAST) Act, a law passed in 2015 that includes a provision for the “Revocation or Denial of Passport in Case of Certain Tax Delinquencies,” that’s how many people are affected, according to ThePointsGuy.

In English? If you have more than $51,000 in unpaid taxes, your passport is in danger.

For now, IRS Division Commissioner Mary Beth Murphy says that passport applications and renewals are simply being denied to offenders, according to the Wall Street Journal. The subtext there being that revocation isn’t out of the question, depending on how the enforcement unfolds. But considering the law is only now being enforced two-and-a-half years after it passed, that analysis will take some time.

So if you pay your taxes, thank you for doing your part so Domino’s doesn’t have to.

But if you owe more than $51K and your passport renewal is coming up, instead of flying to Norway’s 360-degree glacier hotel, use the money to pay down your debt to a safe $49K.

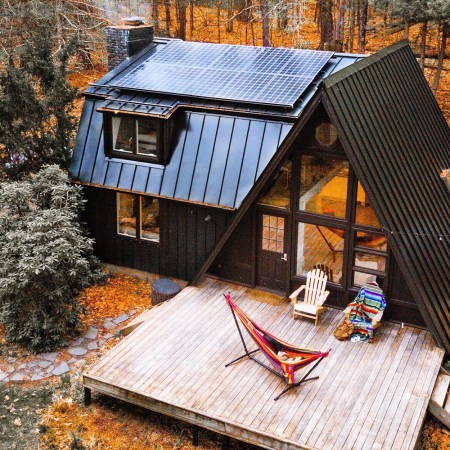

Photo by Sidney Pearce on Unsplash

This article was featured in the InsideHook newsletter. Sign up now.