You’ve probably heard of celebrity death pools, a kind of fantasy football for people who read tabloid obituaries. The premise is simple: you and your friends each draft a team of notable people who are creeping toward the bucket, and if someone on your team actually kicks it, your friends all pay you a previously agreed-upon sum.

Which inspired us to develop a similarly fatalistic, news-based fantasy sport: the startup death pool.

Our inspiration? MoviePass, the subscription movie-viewing buffet that recently moved away from one-film-per-day plans … before quickly veering back, even though most analysts consider the company’s business plan “unsustainable.” Not that they’re only tech company whose wage bill has been called into question of late. Elsewhere, WeWork apparently hemorrhaged close to $1B last year, while Uber reported $1.5B in losses in Q3 alone.

Which begs a couple questions: 1) When will the VC bubble burst, and take some of the biggest names in Silicon Valley with it? And 2) How can we make a sport of predicting who will go first?

Enter the startup death pool. While it still involves real-life people and their livelihoods, it’s not actually about leaving this mortal coil — a moral quandary for those involved in actual celebrity death pools.

Also, it’s always nice to bet against startup hubris.

If you want to ramp up your own startup death pool, a few quick rules: More than two people in your group must have heard of the company you’re betting against (Spotify is good; Bitzbillo is not). And if the startup is already in some sort of legal death spiral — selling of assets, Chapter 11, etc. — they are disqualified. And no insider trading: If you’re involved with or associated with a struggling startup, that business shouldn’t be allowed in any conversation.

For scoring, we’d suggest a variation on Doug Stanhope’s Celebrity Death Pool, offering bonuses and different scores for unique company fails. For example: “The Cambridge Analytica: 25 Points. Company dies because of a Congressional/legal investigation.” (Even though it looks like CA is simply rebranding, which might be its own category.)

And as for where to put your money? We’ve got a few tips on helping you identify the stinkers.

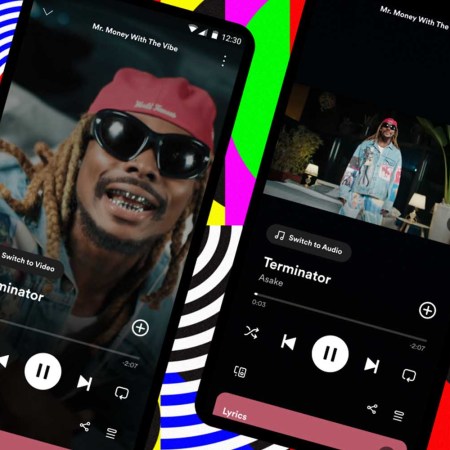

Does this company lose more money with every customer it gains? Good luck getting out of this death spiral. Looking at you, MoviePass and Spotify. Although the latter at least has the backing of several large, established industry players and thus may be “too big to fail.”

Are investors selling off their shares quickly to make a profit? Eh, maybe Spotify isn’t as rock solid as it seems. And Amazon and Apple Music, which need no profit to continue, are gaining ground.

Is the company spending out of control with no endgame? You might want the long game with Netflix, which may soon spend $16 billion in programming and has to compete with a deep-pocketed service from Disney. And you may want to play the very short game with WeWork. (Side note: pretty much every company we mention here, except the next two, is something we use, like and enjoy.)

Does the company make an overpriced device or service that serves no purpose? Then you’re Juicero.

Is this idea something like Bitcoin? Quick, Google “cryptocurrency bubble.”

Any additional resources you’ve got for me? There’s actually a whole cottage industry of people who describe why startups fail, so bookmark a few of those and follow the news. To track startups, we personally suggest StrictlyVC and BetaList, which are both great for charting business comings and, well, goings.

Now hit the books, and enjoy your draft.

(Main image: Flickr CC)

Whether you’re looking to get into shape, or just get out of a funk, The Charge has got you covered. Sign up for our new wellness newsletter today.