Every market has its boom and bust cycles. The secondary sneaker market, for instance, was a $2 billion dollar industry last year, with projections that the bubble for popular models such as the Air Jordan III and the Nike SB Dunk could reach $6 billion by 2025.

But that was all before coronavirus, and with it a new recession. If anything was going to deflate the sneaker bubble prematurely, it was a pandemic. Would the secondary sneaker market be sturdy enough to withstand the economic shock of shoe brands delaying releases? Resellers with physical stores like StockX, GOAT, Flight Club and Stadium Goods have shuttered. With dire unemployment numbers in April followed by a lower unemployment rate in May, then an uptick in June, would there be enough of a consumer base to purchase sneakers and keep the market afloat?

The good news is that the online presence of the reseller market has been steady overall. Online retailers like StockX and GOAT have been able to withstand the pandemic with relatively few bumps in the road. “We are fortunate to have diversified our offerings over the years with digital and brick and mortar presences, along with supporting both the resale and primary markets,” a GOAT spokesman tells InsideHook. “Because we’re still primarily digital and have an incredibly resilient team, our business has been able to persevere during these uncertain times, and the demand on our platform has sustained.”

For StockX, there was an initial four-percent decline in the prices of their top 500 sneakers when the lockdown started, according to company Senior Economist Jesse Einhorn. Now, after re-measuring the data in June, there has been a six-percent price increase over the past four months. “About 300 of the top 500 sneakers have increased in price since the lockdown began and only 200 have decreased in price,” says Einhorn. “The average sneaker is actually doing a little bit better than it was before.”

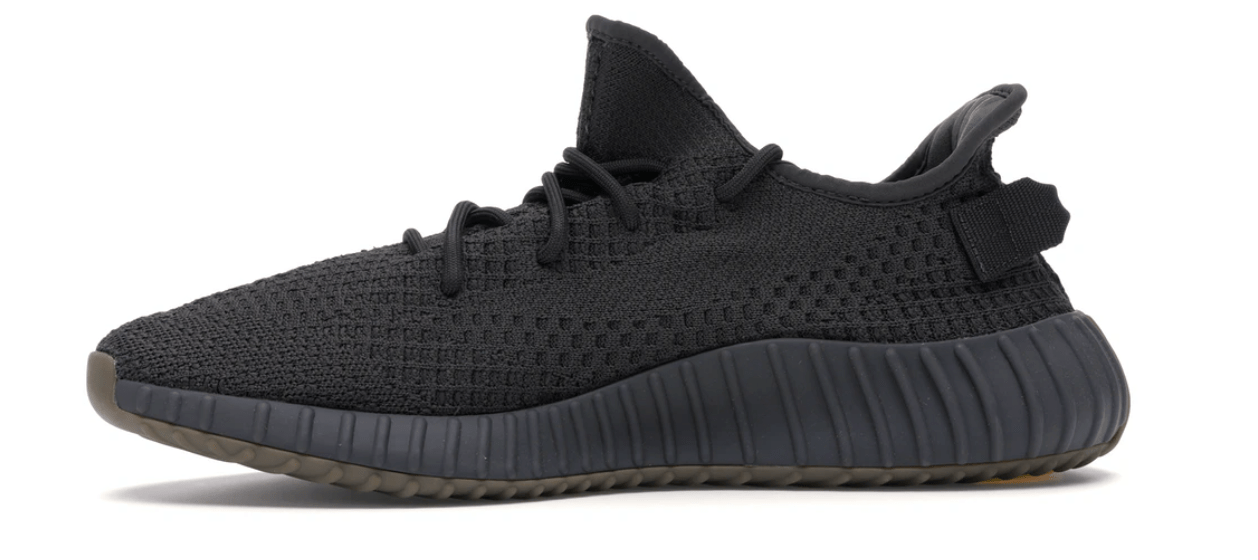

Looking at every shoe does show a different story on StockX. The recent Adidas Yeezy Boost 350 V2 “Cinder” has shown only a modest increase in price sales since its release in mid-March. Released in 2017, the Jordan 1 Retro High Off-White “Chicago” has reached its peak in early May, selling for $4,858. On the flip side, the Nike Air Max 270 React ENG “Travis Scott Cactus Trails” has flattened out in sales since its release last month.

An unexpected boon to the secondary sneaker market was The Last Dance documentary. The 10-part ESPN Documentary covered the Chicago Bulls dynasty and prominently featured superstar Michael Jordan. A rousing success during the pandemic, The Last Dance’s first two episodes set a network record with 6.07 million same day viewers.

All 10 episodes recorded at least one million more viewers than ESPN’s previous high for a documentary, which was 2012’s You Don’t Know Bo. Scenes in the doc prominently featured Jordan’s shoe deal with Nike and the shoes he wore throughout his time with the Bulls. The 13 silhouettes that Jordan wore during his time in Chicago have been a huge success on the resale market for decades. The documentary only augmented an already strong demand for Jordan’s sneakers.

The attention of the shoes directly led to a surge in Google searches for some of Jordan’s grails. StockX saw a 76-percent increase in site traffic on the Sundays that The Last Dance aired in April and May, according to Einhorn. According to the GOAT spokesman, there was a 68-percent uptick in GOAT’s Air Jordan sales within the first few weeks of airing.

Another way that StockX and GOAT have weathered the lockdown storm is that they feature other products outside of sneakers on their respective sites. Apparel, collectibles and accessories have received a bump in price points due to more people practicing social distancing and staying home. Though they are a small piece of the collectibles section at StockX, puzzles have grown by 582 percent in Google My Business (GMB). Unsurprisingly, masks have risen 282 percent in GMB since the lockdown began, and slides are up 364 percent.

How Indie Sneaker Resellers Are Dealing with the Pandemic

Ryan Fresen operates his own shop, 860_Kicks, and has built the business from scratch. Based in Hartford, Connecticut, Fresen began selling shoes around the age of 14. Initially a collector, he saved money from working at Stop & Shop while in high school. When he moved on to college, he had more free time and shifted from collecting to more of a business psyche. The sales from his business assisted in paying off college expenses.

Now, at the age of 25, Fresen has transformed what was once a hobby into a career through the trials and tribulations that come with the reselling business. “What people don’t see is all the roadblocks and hardships,” Fresen recalls. “People just see the expensive shoes I sell. It’s more than that. I’ve lost so much money by being scammed but you take that and learn from it and grow and use past experiences as motivation to not allow certain situations to happen again.”

David Villarreal is 23 and lives in Albany, New York, where he runs The OG Kicks. His shoe fanaticism began with a pair of Nike SB Dunks that he bought from a friend in high school. While in the Marine Corps, Villarreal continued to collect, but funds were low while maintaining his hobby. He created an Instagram page to sell and buy classic shoes. At first, it was a struggle, but through the help of a few established sneakerheads, Villarreal built a network.

In two years, he’s grown the page from 100 followers to more than 12,500. He hopes to make it a full-time business once his time serving in the Marines ends. With growing pains — like balancing college with work, his time in the Marines and overcoming self-doubt — it took Villarreal time to grow his business. “Now my company runs smoothly,” says Villarreal. “I don’t like to talk about numbers, but with the way the business has grown I can see myself making this a full-time job.”

For Fresen, the lockdown has not been a deterrent outside of a brief pause on his international sales (which make up five percent of his transactions), due to custom fees and high shipping costs. “Last month was my best month ever, doing $168K in revenue,” says Fresen.

Villarreal had a layered experience with the lockdown. “In the first month my business slowed down,” says Villarreal. “Sales were not as frequent but within the second and third month of everyone staying at home, I believe a lot of people had time and money to keep hunting down the sneakers they wanted and soon discovered my page had a lot of those gems.”

Fresen does use GOAT and StockX to sell, but his primary vehicle towards his gains is his Instagram page, where his reach of 47,400 followers is considerably large. “I feel the apps are helpful to a lot of other types of resellers, but in my business I sell to a community of people who don’t mind a used sneaker,” says Villarreal. “I also don’t like having my products everywhere, I’d rather have one place selling. GOAT is an amazing app and StockX does a good job too, I just like using my own page.”

The Future of the Sneaker Resale Business Post-Pandemic

What will the reseller market transform into post pandemic? It could end up stabilizing due to the online nature of the business. “We believe there will be an accelerated growth of the resale market and platforms like ours due to the dynamism of pricing,” said the GOAT spokesman. “It’s much more flexible to market conditions, whether up or down. We also believe people will increasingly look at what they already own as potential currency to sell on platforms like ours.”

The reselling marketplace is quicker to adjust to social distancing and lockdown restrictions due to the lack of face-to-face interactions. “I have no reason that the sneaker market will be anything other than resilient and growing over the next year or two,” Einhorn says. “One of the big advantages and disruptive changes at marketplaces like StockX is that sneaker resale has shifted to more of an online marketplace. If you think about the pre StockX era, it depended a lot more on face to face interaction.”

For the individual resellers, it’s about work ethic and the hustle nature of the reselling business. Fresen regularly puts in 80-hour work weeks with help from his girlfriend. “I don’t look at it any different, my hustle and hunger will remain the same no matter the circumstances,” said Fresen. “I see the bigger picture, I know where I want to go and I don’t plan on stopping.” The reselling business never stops. “You could say that sneakerheads don’t take any time off of buying,” quips Villarreal.

This article was featured in the InsideHook newsletter. Sign up now.