Over the next two weeks, we’ll be publishing a series of interviews with thought leaders from a number of industries about the impact of COVID-19 and — more importantly — the improvements they expect to last well into the future. Get to know Post-Pandemic America.

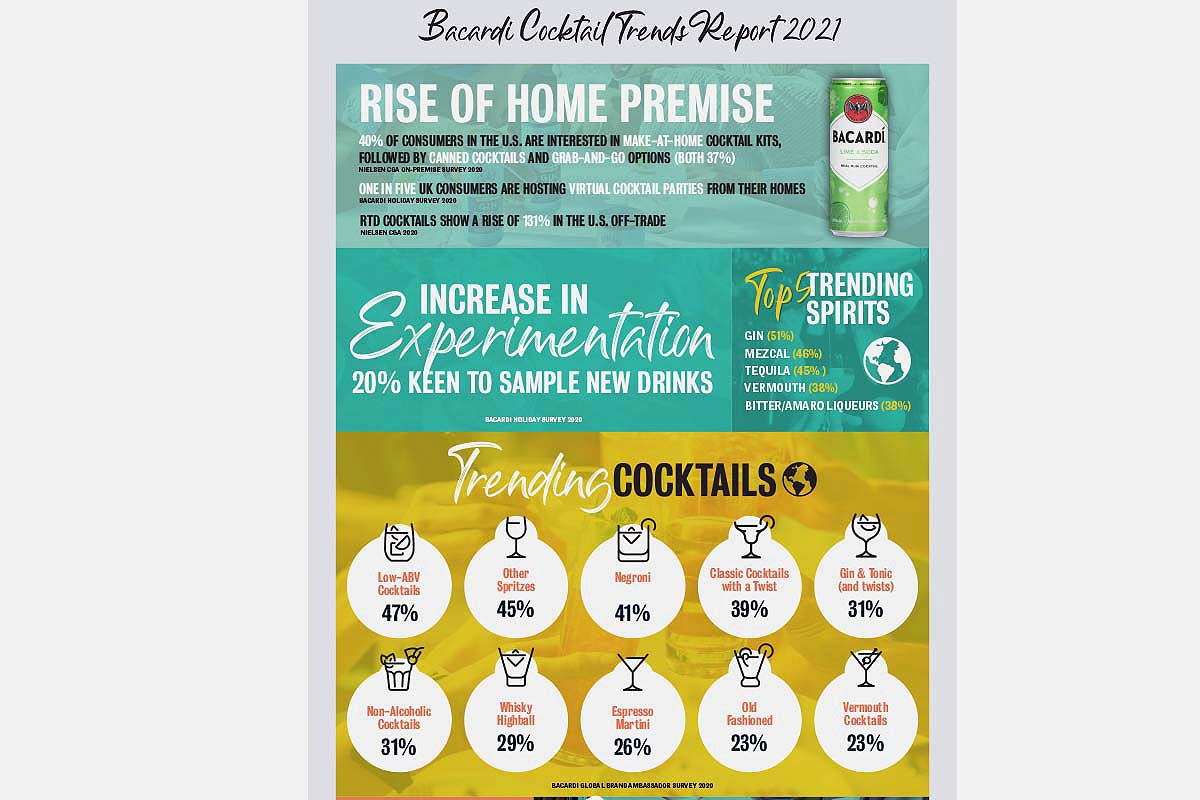

Every year, drinks giant Bacardi publishes a Trends Report, and it’s a thorough and accurate bellwether of where the alcohol industry and drinking habits in general tend to be headed.

Obviously the global COVID pandemic has screwed up a lot of forecasts. But while the hospitality sector was hit extremely hard, a lot of good came out of the last year. And some of those workarounds and habits born out of a bad, stuck-at-home year could lead to some real innovation within the booze industry.

Canned cocktails and delivery drinks, e.g., seem like they’re here to stay, even as the country undergoes a partial reopening. And during our time in lockdown, a whole lot of people became home bar enthusiasts and amateur mixologists — so drinks quality and knowledge is way, way up as well.

And whether we’re stuck at home or going back to the bar, we’re all buying the good stuff now. “People are replacing spend on holiday travel and commuting with spend on quality food and drinks,” explains Bacardi’s Global V.P. Strategy Insights and Analytics, Brenda Fiala, who helped us decipher the 2021 Trends Report. You can find highlights of the full report here.

InsideHook: How did your team put this annual report together?

Brenda Fiala: Bacardi’s global footprint allows us to regularly connect with a vast community of brand ambassadors, many of whom have been bartenders and continue to work closely with other bartenders who have a pulse on how and what people are drinking. This year, we also collaborated with The Future Laboratory to include more universal trends and insight on how these trends are being embraced by people in different countries. In addition, we tapped into external research commissioned by Nielsen CGA as well as our own consumer surveys created by Bacardi over the holidays.

Are delivery and to-go cocktails here to stay? What other COVID-related measures do you see sticking around?

Absolutely. Within weeks of lockdowns, consumers discovered they could have cocktails delivered right to their door or picked up from their local restaurants.

We are watching the rise of a new culture of convenience, powered by the meteoric rise of e-commerce, with platforms like Drizly growing by 350% in 2020, according to IWSR. Cocktails to-go have taken off in many markets, with bars and consumers embracing the trend as a viable choice for social occasions, and we’re seeing it continue to be a popular option even in markets that have reopened.

It appears that gin, mezcal and tequila are booming — why do you think they’re doing particularly well?

Gin, mezcal and especially tequila are categories that were already on an upward trend in the U.S. before the pandemic. Once lockdowns kicked in, the growth of these categories exploded because people realized they could make their favorite drinks at home and found joy in the process of cocktail-making. The popularity of drinks like the spicy margarita, smoky Old Fashioned with mezcal, spritzes and negronis fueled people’s desire to make them with premium quality spirits to recreate the restaurant and bar experience at home. People are replacing spend on holiday travel and commuting with spend on quality food and drinks. There’s a sentiment of nostalgia and a craving for comfort that’s driving the desire for classic cocktails, albeit with a twist, which in turn is increasing the sale of premium spirits in these categories.

Is there any category that may run into slower growth in the near future?

As people venture beyond their cocktail comfort zone in lockdown, they’ve been exploring extreme flavors, including those that are super-sweet. Classic cocktails with liqueurs, syrups or bitters offer nostalgic comfort with a bold twist, and we’ve seen a rise in demand for liqueurs and cordials in the last year. However, as we come out of lockdown and emerge from our sweatpants, we anticipate that consumers will turn towards ingredients with natural flavors and that we’ll start seeing slower growth in this category overall. Premium liqueurs will continue to see appreciation, but consumers will be seeking ingredients with fewer artificial additives and reduced refined sugar.

What’s peaking now?

Through the pandemic, people’s appetite for convenience and a new abundance of caution have together sparked a 131% rise in ready-to-drink (RTD) canned cocktails in the U.S., according to Nielsen CGA. Consumers like the ease of enjoying their favorite cocktail in the can format: it’s incredibly convenient and portable, which are factors that consumers appreciate even more so today as they look for safe consumption occasions, many of which are outdoors.

So with more people socializing outdoors, in parks or on rooftops, there is greater need for drinks that are easy to pack and transport. This option has taken off in popularity over the past few years, and we only expect more excitement and innovation in this segment. People are telling us they are not going to give up convenience and great tasting RTDs.

What’s the biggest difference you find between American drinking habits and the rest of the world?

While Western Europe is leading the growth trend of low-ABV and non-alcoholic, or NoLo, options, this trend is moving at a slower rate overall in the U.S., where consumers are gravitating toward traditional cocktails with a twist. However, a mindful drinking trend we have seen boom in the U.S. is the spritzing culture, as the country begins to embrace this European easy cocktail. For example, Bacardi has launched its Martini & Rossi Fiero vermouth in the U.S. after a successful run in the European market.

What was the biggest surprise regarding this year’s report?

How quickly consumers embraced their inner mixologist during lockdown. Many people have taken the time at home to learn something new and discover how fun making cocktails can be while embracing more elaborate premium spirits and ingredients. We saw a spike in internet searches for “cocktail recipes” throughout the past year, and 40% of U.S. consumers were actively looking for cocktail kits at the end of 2020, according to Nielsen CGA.

Do you see any nascent drinks trends now that’ll get much bigger in the next few years?

When it’s safe to return to the bars, we expect that consumers are going to be more informed and creative, which will lead them to be more appreciative of bartenders’ skill. Consumers will be more confident with their newfound knowledge of spirits and cocktails that will fuel a reinvention of the bar and continue to expand the varieties of cocktails.

We also anticipate seeing consumers follow through on their desire to support local brands and businesses. People are showing tremendous support of their local restaurants and bars — from buying gift cards in advance to showing up and ordering regularly to keep their communities vibrant. We expect to see a greater rise in outdoor dining options, too.

And a focus on sustainability continues to gain traction amongst both consumers and brands. People are paying attention to the burgeoning zero-waste bars and restaurants that they can feel good about supporting and doing their part for the planet.

Let’s say we get COVID under control by the end of 2021. How long until the hospitality industry recovers?

Recovery speaks of averages — the average number of people going out, average number of accounts re-opening. The recovery will be uneven. Customers that are coming back are seen to be spending as much or more than they previously were. This is good news for many accounts. We also see, through Trip Advisor and Morning Consult surveys, that people are planning up to three domestic trips this year. This will ensure many places around the U.S. will see an influx of domestic tourists. We already see higher hotel occupancy rates in the Sunbelt states, and as more people receive their vaccines, they will likely become more confident to travel and go back to their favorite restaurants and bars. Many are already predicting that the restaurant and bar industry will see increases this year, and that’s a good first step.

I always hear that every year is the year of rum. But what do you think 2021 is the year of?

Instead of naming just one spirit, I would say that 2021 is the year of drinking premium spirits since we’ve seen varying popularity in each market, with premiumization as the guiding force globally. For example, in North America, we’re seeing the rise of premium tequila, cognac and dark rum, while Europe is seeing popularity in the gin category. It’s whatever year you want it to be — cheers and enjoy responsibly.

Join America's Fastest Growing Spirits Newsletter THE SPILL. Unlock all the reviews, recipes and revelry — and get 15% off award-winning La Tierra de Acre Mezcal.