Twenty-plus class action suits have been filed across the country since the massive data breach at credit reporting agency Equifax. One came courtesy of Oakland lawyer Scott Cole’s eponymous law practice.

Below, he helps us compile a to-do list for every American affected by the hack — all 143 million of us.

InsideHook: What should consumers do to minimize their exposure to the Equifax breach? What comes after freezing your credit, like John Oliver told us to do?

Scott Cole: Consumers need to be proactive, and beyond just freezing their credit. There’s access to credit information, and then there’s the use of it in some illegal way — both are troubling, but only the latter will be noticed. The average consumer may not know about use of his personal information until it’s too late, so I suggest a number of things: review credit card and bank statements thoroughly and don’t let little charges go unchecked, open your mail (something we often don’t do) to see what’s being sent to you, pull your credit reports regularly and sign up for fraud alert services. These tasks are a hassle, but having your identity stolen can put your financial life on hold for years.

IH: What if you just want to opt out of the entire credit-reporting process?

SC: Unfortunately, there is no way to fully exclude yourself from the service at this time. Presumably, Equifax only has information on creditors who have made that information available in one way or another in the past. The only way to block Equifax’s — or other agencies’ — use of that information is to not apply for further credit and/or put freezes on the agencies’ use of what information they already have.

IH: If you’re “mad as hell,” what are your options? Writing the governor?

SC: Writing your state and federal representatives is an excellent idea. If you do, you can ask them to support various legislation that has been proposed in prior years — like the SECURE Act proposed by Senators Schatz, Sanders and others. [See more information on legislative proposals here.] Unfortunately, companies like Equifax have become so large because citizens demand credit and because underwriters of loans, bank, etc., want to minimize the risk of their investments. Less reliance on credit, and taking greater responsibility for living within our means, is the best organic way to make credit agencies less necessary, and less powerful.

IH: How optimistic are you that our governing bodies will have the wherewithal to rein in these agencies? Individuals have been saying for years that basic errors on their credit reports have caused catastrophic personal damage. Even the SECURE Act seems to just nibble away at a larger problem.

SC: That three dozen states are investigating is enormous and shows they’re taking this very seriously. I can’t speculate what they’ll do, but it’s going to be dramatic. Voters will demand that. Yes, the SECURE Act doesn’t solve everything, but legislation that tries to solve everything about which consumers complain, and all at once, would be an unwieldly bill and would not likely find bipartisan support. I think the Equifax data breach was a catalyst for some good legislation. I’d like to see Congress now keep that momentum up by installing at least a few piecemeal approaches to the problem.

IH: How does the class-action play into that?

SC: I have to believe our litigation will have a major impact, not only on how Equifax handles itself in the future, but on how other agencies treat our sensitive information. Class actions are incredibly powerful tools for leveling the playing field between big business and consumers, between employers and employees and within other traditionally imbalanced commercial relationships. What’s more, the fact that three dozen state attorneys general are also investigating this massive breach will undoubtedly have a major impact on the integrity of Equifax’s systems and internal procedures going forward.

IH: Let’s go back to something you said earlier: “Less reliance on credit, and taking greater responsibility for living within our means is the best organic way to make credit agencies less necessary, and less powerful.” What’s your take on the American idea of consumerism?

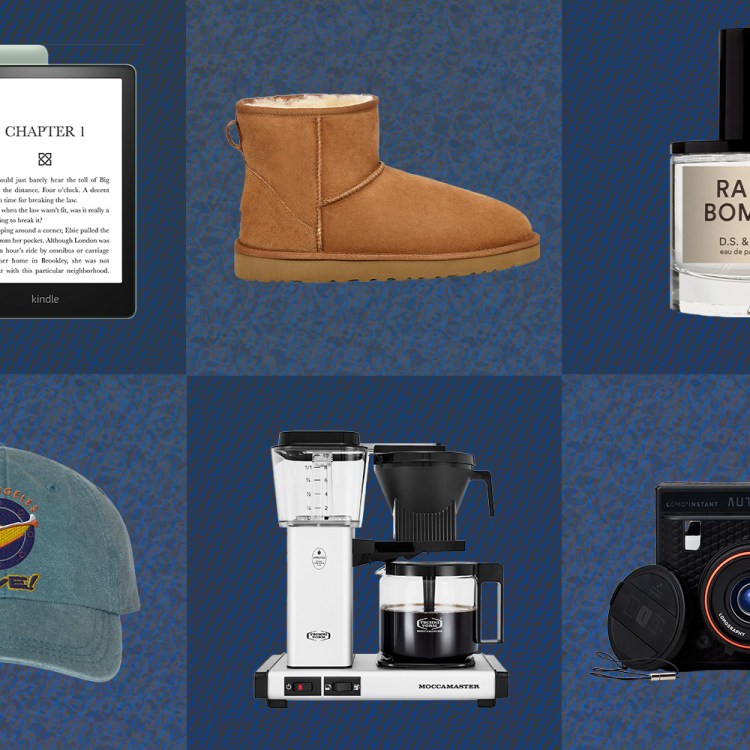

SC: Well, now we’re getting philosophical, but I don’t think consumerism is anything new. History is replete with examples of people living to excess — from kings to Rockefellers to movie stars — but the media today and its advertiser clients do an excellent job in making the average American worker think riches and the material goods riches can buy are more obtainable than they usually are. And they do a great job convincing many of us that we need things we don’t really need. I guess I’d say the scope and popularity of consumerism has changed, but not the concept itself. As to what we do about it? My earlier suggestion about “taking greater responsibility for living within our means” really starts with a rejection of advertisers’ message that tells us how we should define success, and happiness — and that we’ll not achieve them unless we buy their stuff.

This article was featured in the InsideHook SF newsletter. Sign up now for more from the Bay Area.